Business Insurance in and around Little Rock

One of the top small business insurance companies in Little Rock, and beyond.

No funny business here

Business Insurance At A Great Price!

Small business owners like you have a lot of responsibility. From tech support to inventory manager, you do whatever is needed each day to make your business a success. Are you a veterinarian, a pet groomer or a locksmith? Do you own a clock shop, a dance school or a pottery shop? Whatever you do, State Farm may have small business insurance to cover it.

One of the top small business insurance companies in Little Rock, and beyond.

No funny business here

Protect Your Future With State Farm

The passion you have to contribute to your community is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Elston Strong. With an agent like Elston Strong, your coverage can include great options, such as commercial liability umbrella policies, business owners policies and commercial auto.

As a small business owner as well, agent Elston Strong understands that there is a lot on your plate. Reach out to Elston Strong today to get more information on your options.

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

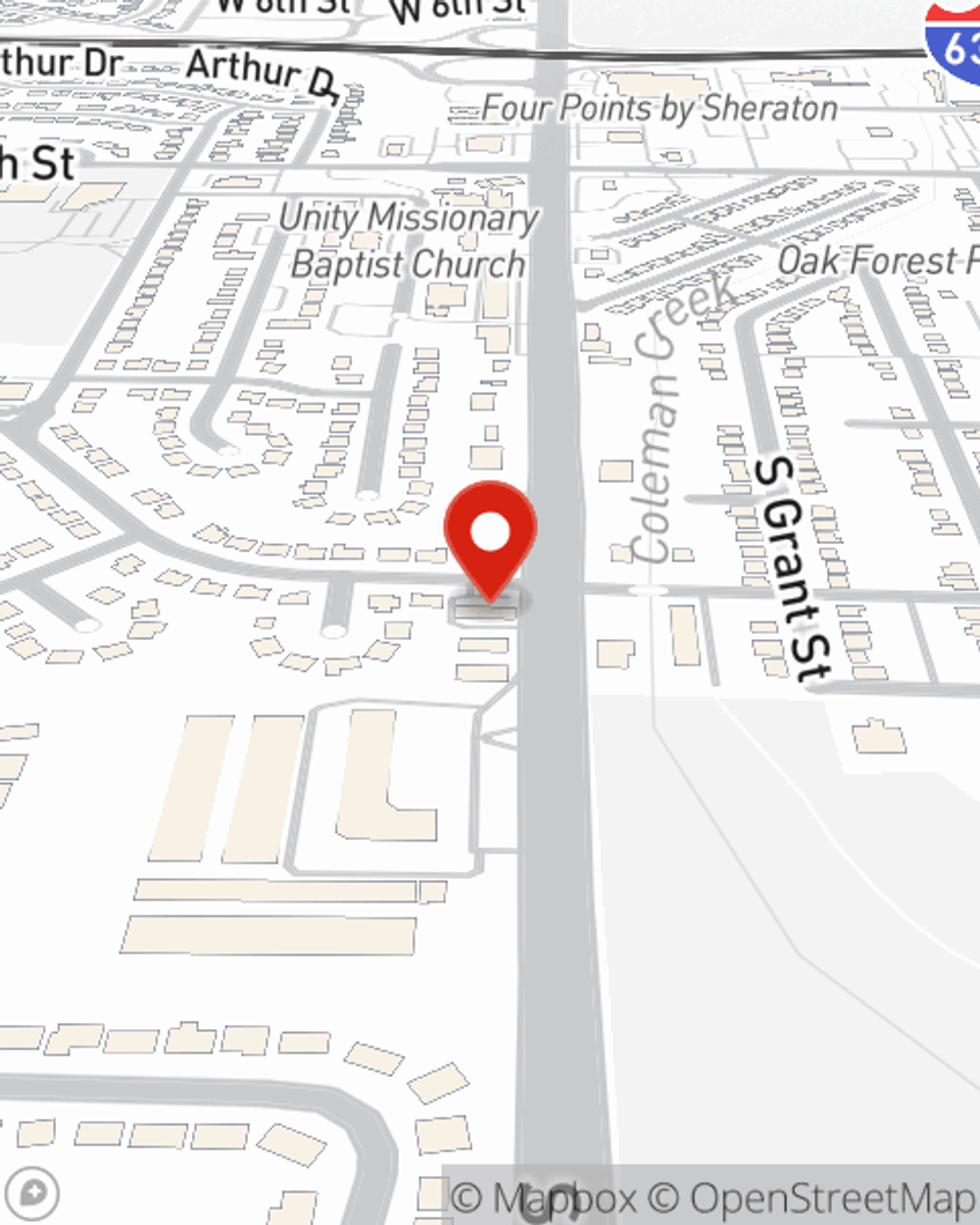

Elston Strong

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.